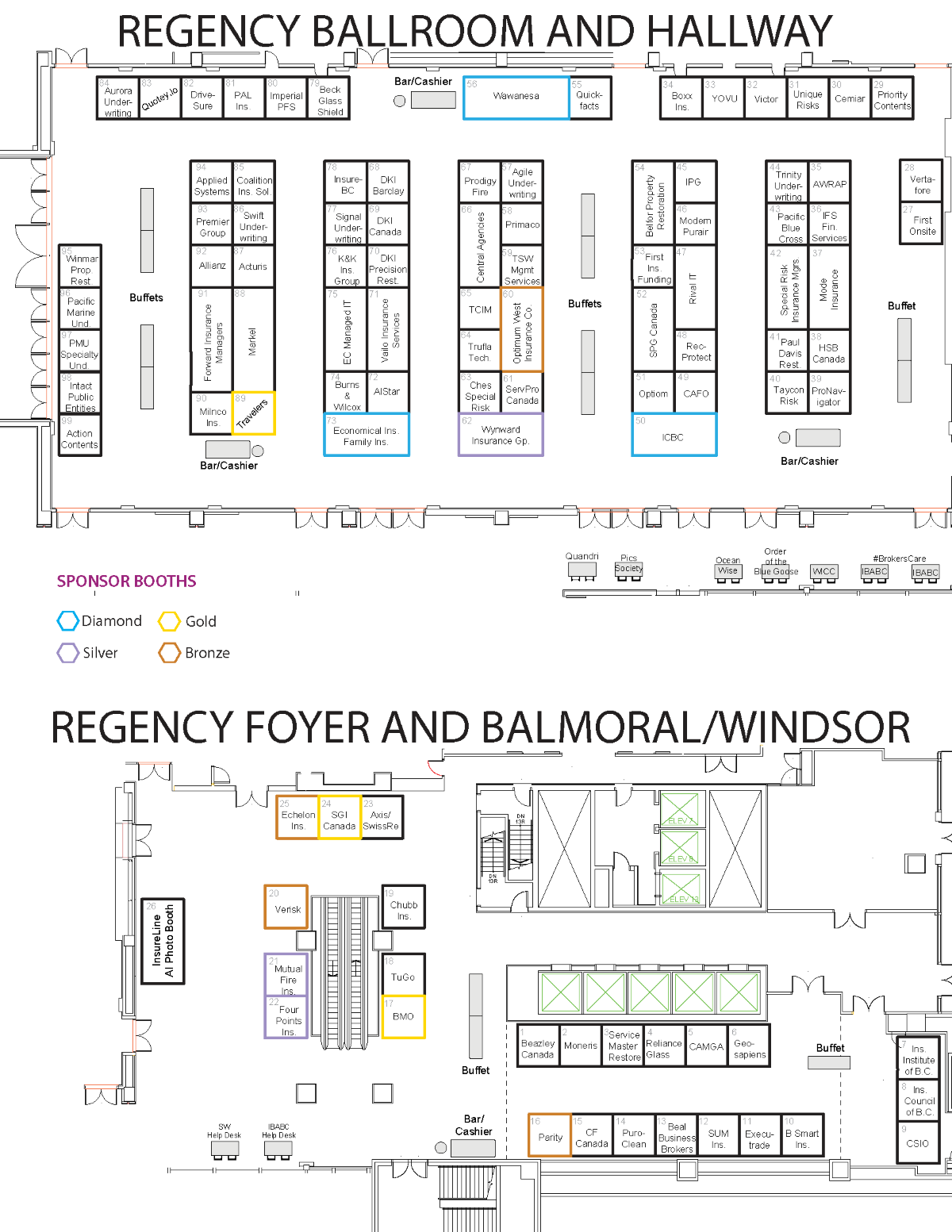

Exhibitors

2025 TRADE SHOW EXHIBITORS

(click map to open as larger pdf)

Benefits

| Company | Description | Contact Information |

|---|---|---|

|

Parity Agencies Ltd is 100% Canadian owned and family operated brokerage. Proudly administering the Group Benefits and GRSP Plans for the IBABC for 20+ years. For over 40 years, we have provided best in class customer service, ensuring transparency with our clients and quality offerings designed to meet their specific needs. |

Kevin Steegstra 604-864-4020 Kevin@parityagencies.ca benefits@parityagencies.ca |

Broker

| Company | Description | Contact Information |

|---|---|---|

|

Central Agencies is a full service independent Broker since 1989. We are 100% Canadian owned and family operated brokerage. We operate in British Columbia, Alberta, Sask. And Manitoba. We welcome the opportunity to earn your business. |

Val Urban |

Claims Services

| Company | Description | Contact Information |

|---|---|---|

|

SCM Insurance Services brings together leading brands in risk management and claims solutions. IPG specializes in international TPA and MGA services, offering cross-border expertise. ClaimsPro is Canada's largest independent adjusting firm, delivering professional claims management across all lines with national reach and local responsiveness. |

Petar Germanski James Kozak |

Finance

| Company | Description | Contact Information |

|---|---|---|

|

BMO has over 25 years of expertise in the Property & Casualty industry with competitive and customized solutions. To learn more about our exclusive offer for P&C brokerages, visit our booth to speak with one of our specialists. |

Denny Chew |

| CF Canada Financial Group |

|

|

|

FIRST Insurance Funding of Canada(FIRST Canada) provides the Canadian Insurance Market with innovative payment solutions. Brokers, MGAs, and carriers can partner with FIRST Canada and expand their offering to provide more value, choice, and convenience for all their clients. The combined strength of FIRST Canada’s dedicated team, evolved offering, and innovative platform position its partners to meet the demanding future of the Canadian Insurance landscape armed with market-leading solutions for success. |

Tas Kurji |

|

Canada’s broker-first premium finance partner. IFS makes insurance premium financing seamless—brokers never chase client payments, thanks to our exclusive Cancellation Prevention Process. More clients stay insured, fewer policies lapse, and quotes are ready in seconds with NexxWAVE. Trusted by brokers nationwide for 45+ years, with real support from real experts. |

Brad Moore |

|

Imperial PFS Canada is the leader in commercial and personal payment solutions. We help Brokers, Carriers and MGAs across Canada grow by offering custom financing programs and letting them focus on one priority: selling insurance. Our experienced payment solutions specialists are dedicated to providing your customers with the best payment plans for their needs. |

Jennifer Petford |

|

A proudly Canadian joint venture, Moneris has been partnering with business owners for more than 20 years. |

Kelly Reaume |

|

Primaco is 100% Canadian owned and operated. In business since 1962, our priority is to offer fast, accessible and simplified service to our customers. We offer best-in-class financing. Simplicity, transparency, speed and quality of work are the values that define us and contribute to our solid reputation. |

Chris Naismith |

Managing General Agent

| Company | Description | Contact Information |

|---|---|---|

.png) |

Agile is a modern and innovative MGA delivering niche and hard-to-place solutions for brokers and their clients coast-to-coast. |

Sara Williams |

.png) |

AWRAP Insurance Services Inc. provides British Columbians with premier vehicle replacement coverage solutions. While AWRAP’s core focus is protecting clients in the event their vehicle is a Total Loss, additional coverages can be added to include supplementary protection for the vehicle’s loan and Partial Loss claims as well. |

Asees Gill |

|

Beck Glass Shield is a best-in-class MGA with a strong predilection for all things glass and glass insurance. Beck is poised to provide well-structured glass insurance services to property owners in British Columbia, Alberta, Ontario, Saskatchewan, Manitoba, Nova Scotia and the Yukon by utilizing state-of-the-art digital technology. |

1-888-483-9929 |

|

|

||

|

Burns & Wilcox is the largest independent insurance wholesaler and MGA operation in North America, with over 2,000 dedicated and experienced professionals. Burns & Wilcox is, at its core, a solutions-based company. We’re proud of our ability to offer the perfect plan to match your needs. And to do it quickly, with ultimate efficiency and attention to detail. |

Michelle C. Allemang |

|

CHES Special Risk was established as a Managing General Agent and Wholesale broker in 2004, in response to broker demand to a hardening marketplace, commencing with a particular specialty in the entertainment and hospitality business, becoming a fully accredited Lloyd’s cover holder in 2009. |

Kirstie Faferek |

|

Drivesure offers Vehicle Replacement products for your brokerage or mobile road service operation. Our unique products allow you to offer full replacement on vehicles 5 years old and newer including add-on coverage for Partial Loss Deductibles and Diminished Value. Available for both BC and Alberta licensed brokerages. |

Alison Phelps |

.png) |

Forward Insurance Managers Ltd. is an independently owned InsurTech MGA focused on traditional underwriting-service paired with modern technology (JET). We keep it simple. Our insurance products are exclusively distributed through brokerages. Providing a personalized service where our underwriting and claims people are easily accessible. Our focus is People PLUS Technology. |

marketing@forwardinsurance.ca |

|

At InsureBC Underwriting, we offer tailored solutions from experts you can trust. Our team is committed to helping brokers build their business by offering unparalleled service and industry-leading products. Products include: Earthquake Deductible Buy-Back; Water Deductible Buy-Back; Commercial Lines products; Personal Lines products, including High Value Homes. |

Personal Lines – Allison Bergen |

|

For more than 30 years K&K Insurance Canada has insured the World’s Fun! From our humbling beginnings in motorsport, K&K Canada is a leading MGA provider of speciality risk in sports, entertainment, leisure, and recreation. |

Angela Barham |

.png) |

Milnco Insurance Broker Solution Centre is an independently owned Canadian Managing General Agent and Wholesaler focused on providing top-notch service to brokers in Alberta, British Columbia, Manitoba, Saskatchewan, Ontario and the Yukon. Commercial P&C target classes include builder’s risk, contractors, construction, commercial realty, hospitality, manufacturing, retail, as well as Umbrella and Excess Liability. |

Milnco Broker Solution Centre |

|

Mode Insurance Services is one of BC’s leading Vehicle Replacement Insurance providers. Mode offers Vehicle Replacement and Loan protection products for new, used, and leased vehicles. Our policies go beyond basic replacement – offering partial loss benefits on all replacement policies. We keep it simple, convenient, and affordable for your clients. |

Maz Mohammadi |

|

Optiom Inc. offers vehicle replacement insurance for new, used and leased vehicles! For more than 15 years, Optiom has helped Canadians worry less about their financial position and lifestyle when it comes to the benefits provided by traditional auto insurance. |

Natalie McIntosh |

|

PMU Specialty Underwriting Managers is a dominant MGA in Canada in select niche industries. We listen, we exceed expectations and always treat our brokers as partners. We are bold in our pursuit and offer distinct timely dynamic solutions, atypical products and first class service. |

Mashood Ali |

|

PAL Insurance Brokers is Canada’s leading Specialty MGA, providing Special Event Liability, Weddinguard, Hole in One, Contents in Storage and a new line of Commercial products, plus much more. PAL’s advanced Broker Portal allows quick and easy applications and immediate policy issuance for many programs. PAL is proud to have offered all of our programs to Insurance Brokers in BC for over 35 years! |

Amber Morrison-Givens |

|

Established in 1989, PREMIER has a National presence across Canada with offices in Vancouver (head office), London (ON), Cambridge (ON), Toronto (ON), Laval (QC) and a virtual presence in Calgary. PREMIER has experienced tremendous growth since opening or doors in 1989 as a Marine Pleasurecraft market. Today, PREMIER one of the largest Specialty Markets in Canada with a mix of Commercial, Specialty Personal Lines & Marine business. |

Jennifer Lehman |

|

RecProtect Insurance Services Inc. is a Canadian Insurtech MGA offering modern insurance programs for recreational risks such as trailers, watercrafts, cottages, and more. Backed by Four Points Insurance, we empower brokerages with instant quoting, easy binding, and full support from submissions to claims. |

Ashley Colina |

|

SIGNAL Underwriting Inc. is an independently Canadian owned MGA that brings unequalled value to our three customers; tailored insurance coverage and products for individual insureds, support and industry knowledge for our broker partners, and expert underwriting for our insurance carriers. SIGNAL is an approved Coverholder with Lloyd's of London. |

1-833-559-5995 |

|

As an MGA with a 30+ year history, Special Risk Insurance Managers is dedicated to finding solutions to Specialty & Niche risks for our broker partners and the end consumer, while maintaining a consistent underwriting appetite throughout changing market conditions. Our brokers know "We're There" with strength of capacity, broad product range and underwriting expertise. |

Kia Soltani |

|

SPG Canada is Canada’s leading Delegated Underwriting Authority Enterprise (DUAE). Our coast-to-coast presence delivers competitive solutions backed by deep underwriting expertise across 14+ commercial, personal and specialty industry verticals to serve brokers efficiently and effectively. Additionally, Specialty Claims Canada, SPG Canada’s in-house claims management team, supports and delivers high-quality service with integrity, responsiveness, and care. |

1.877.532.6864 |

|

|

SUM Insurance is an independent MGA working with first class insurers to design, underwrite and deliver insurance product to our customers, insurance brokers. We optimize underwriting by bringing expertise to capacity and service to opportunity. We look forward to the chance to create value with you. |

Karen Mak |

|

Swift Underwriting was created for those that need underwriting done quickly, accurately, and correctly. We understand that our client's time is valuable, and we are here to move through the underwriting process swiftly. |

Lyndsay Unland |

|

Our job at Taycon Risk is to give society’s risk-takers cover, giving them the confidence to push us all towards a brighter future. Working with insurance brokers across Canada, we help cover niche markets, hard-to-place, or complex commercial risk. We will work with you to build tools that help turn complex situations into manageable solutions for your clients. |

Dustin Bales |

|

TCIM is an MGA that offers underwriting solutions designed to suit your commercial property, casualty, and specialty needs. We have many in-house options as well as access to the open market. We are Canada-wide, and our regionally placed underwriters understand unique regional challenges. We also provide USA support for your Canadian based clients. |

Andrew Cilinsky |

|

|

Founded in 1995, TSW Management Services is a national insurance MGA and wholesaler specializing in commercial insurance needs. With offices in Montreal, Waterloo, Calgary and Vancouver, the TSW team assists brokers with both in-house underwriting authority and as a wholesaler representing a vast array of top-tier Canadian licensed insurers and Lloyds. |

Monica Rakhra |

|

Trinity Underwriting A Canadian Managing General Agent (MGA) focusing on Specialty Lines & Sports Liability coverage for Specialized Risks. Let Trinity be your Specialty solution. |

Trinity Underwriting Submissions Team |

.png) |

Unique Risks Ltd. is a Managing General Agent (MGA) specializing in unique, non-standard or hard to place risk solutions for your commercial casualty and property accounts. We are independently owned and operated and have no direct affiliations with any insurance companies or insurance brokerages. |

Ali El-Ahmad |

|

At Vailo Insurance, our strategy involves a return to good old-fashioned common-sense underwriting driven by only the most experienced underwriters, thoughtful automation, strong partnerships, industry leading service and deep data and analytics. With the recent launch of Vee by Vailo brokers are now able to quote and bind coverage through the Vee online platform. |

Tommy Truong |

|

|

Victor Insurance Managers Inc. We’re a managing general underwriter with both eyes fixed firmly on the future. We’ll help you take on tomorrow’s challenges with insight, calm and confidence. Because together, we’re all victors. |

1-800-267-6684 |

Insurer

| Company | Description | Contact Information |

|---|---|---|

|

In today's competitive landscape, travel insurance stands out as a distinct advantage. Partnering with Allianz Global Assistance enables you to sell travel insurance, boost your business revenue, and protect your customers during their travels. Together, we can enhance and strategically position your brand for success. And remember: If your customers aren’t buying travel insurance from you, they’re buying it from your competition! |

Camilla Cannell |

|

Axis Insurance is the appointed Broker for the IBABC Errors & Omissions Program. Our best in class program is known for broad coverage; expertise defending claims; ease of doing business and a proven track record of stability and consistency throughout the market cycles, for more than 30 years. Experience and loss control premium credits available to IBABC Members. We’re the commercial insurance arm of the Swiss Re Group, backed by financial strength and more than 160 years of risk expertise. Our extensive knowledge in traditional as well as alternative risk transfer solutions sets us apart in providing smarter risk products that are globally aligned but tailored to local needs. |

Raquel Cooper Phil Moir Dave Anderson |

|

||

|

Beazley is a global specialist insurer, that enables its clients to explore new ventures, create innovative solutions and build a stronger tomorrow. In a world fast becoming head-scratchingly complex, it relishes a challenge and is seen as the insurance industry's go to problem solvers, seeing every risk as an opportunity to do things differently. |

Bobbie Mansfield |

|

BOXX Insurance helps businesses, individuals and families insure and defend against cyber threats, harnessing the power of ALL IN ONE Cyber Insurance and Protection. Headquartered in Toronto, Canada, with offices worldwide, BOXX is a global, award-winning provider of cyber protection services & cyber insurance coverage. |

Cheryl Hobbs |

|

Chubb is a world leader in insurance. With operations in 54 countries and territories, Chubb provides commercial and personal property and casualty insurance, personal accident and supplemental health insurance, reinsurance and life insurance to a diverse group of clients. As an underwriting company, we assess, assume and manage risk with insight and discipline. |

Erin Noonan |

|

|

Coalition is the world’s first Active Insurance provider designed to help prevent digital risk before it strikes. By combining comprehensive insurance coverage and cybersecurity tools, Coalition helps businesses manage and mitigate potential cyber attacks. Policyholders can receive automated cyber alerts and access expert advice and global third-party risk management tools through Coalition’s holistic cyber risk management platform, Coalition Control®. |

Joel Lauzon |

|

Founded in 1998, Echelon Insurance is driven by the desire to provide outside-of-the-box solutions to meet the needs of Canadian businesses and families. In 2019, Echelon became a member of the CAA Club Group family and is proud to uphold their mission and commitment to ensuring the safety of Canadians by leveraging specialized underwriting expertise to deliver tailored solutions. |

Erica Nelson |

|

Family Insurance Solutions is a leading distributor of home and optional auto insurance in British Columbia. Under the Economical brand, we serve the insurance needs of individual, commercial, and farm customers across the country. Family and Economical are part of Definity Financial Corporation. Definity is one of Canada’s leading P&C insurance companies. Our national, multi-line and multi-channel business model has been built through a combination of strong pricing, risk selection, and claims management capabilities, and a relentless focus on delivering superior service to our customers and brokers. |

Family: |

|

Four Points Insurance delivers tailored commercial insurance solutions for today’s evolving businesses. Known for our exceptional service and innovative, client-focused offerings, we operate exclusively through our broker channel. Our expanded suite—including optional vehicle insurance in BC—enhances our core products and supports brokers with more flexibility and value. |

Christine Young |

|

HSB Canada, part of the Munich Re, is a multi-line specialty insurer and provider of inspection, engineering and risk management services. HSB Canada’s insurance offerings include equipment breakdown, cyber risk, and specialty liability coverages. |

Rachel Cheong |

.png) |

ICBC supports drivers both on and off the road for an auto insurance system that works for all road users. Working closely with employees, stakeholders and partners, ICBC is committed to a safer B.C. and an insurance system we can be proud of — now and in the future. |

Sarah Satte-Case |

|

Intact Public Entities has over nine decades of experience providing specialized insurance programs, including risk management and claims services, to municipalities, public administration and community service organizations across Canada. For more information visit intactpublicentities.ca. |

Wendy Ravaliya |

|

Markel Canada is a division of a London-based casualty insurer, Markel International, and a subsidiary of Markel Group, a diverse Fortune 500 financial holdings company. Markel Canada issues policies on Lloyd's Syndicate 3000 paper. The strength and expertise of Markel International further improves Markel Canada’s ability to assist brokers in solving their client’s needs. |

Olivia Chan |

|

Founded in 1902, Mutual Fire Insurance (MFI) was the first mutual insurance company headquartered in the province of British Columbia. Today, we provide insurance solutions for farms, hobby farms, and homes from British Columbia to Ontario with the support of our broker partners. Find out more by visiting our website! |

Business Development Team |

|

Optimum West Insurance Company proudly underwrites P&C insurance in B.C. as a subsidiary of Optimum General Inc. Optimum West, with branches in Vancouver and Edmonton, writes personal property insurance and commercial property and liability insurance in B.C., Alberta and the Yukon. |

Satomi Tada |

|

Pacific Blue Cross is British Columbia’s #1 health benefits provider. Based in Burnaby, BC, the not-for-profit organization has over 75 years of experience in offering the world’s most recognized health, dental, and travel plans. |

Michelle Ortiz |

|

|

SGI CANADA is the property and casualty insurance division of SGI, offering products in 5 of Canada’s provinces. It operates as SGI CANADA in Saskatchewan, British Columbia, Alberta, Manitoba, and Ontario. SGI CANADA Products are sold through a network of independent insurance brokers. |

Nate Edwards |

|

Travelers Canada is a leading provider of property and casualty insurance for home, auto and business across Canada. Taking care of our customers and communities is at the heart of what our 1,400 employees bring to work every day. |

Daniel LaRose |

|

|

Trusted by millions of Canadians, visitors to Canada and international students to support them in their travels within Canada and across the globe, TuGo is one of the nation’s top travel insurance providers. Since 1964, TuGo has been proudly Canadian-owned and operated, specializing in travel insurance products & in-house services including 24/7 emergency medical assistance, claim administration and customer service, with support in 27 languages |

Chad Hofmann |

.png) |

Wawanesa, founded in 1896, is one of Canada’s largest mutual insurers, with over $4 billion in annual revenue and assets of $11.5 billion. Wawanesa is the parent company of Wawanesa Life, which provides life insurance products and services, and Western Financial Group, which distributes personal and business insurance. Wawanesa proudly serves more than 1.87 million members in Canada. To help the strengthen communities it serves, Wawanesa donates more than $3.5 million annually to charitable organizations, including over $2 million annually in support of people on the front lines of climate change. |

BC Business Development |

%20png.png) |

For over a century Wynward Insurance Group has been insuring Canadian Businesses from coast to coast with innovative products and services. Wynward strives to be a trusted partner to our broker network by providing exceptional service. Wynward is a 100% Canadian owned Insurance Company and carries a Financial Strength Rating of A (Excellent). |

Robert Medeiros 778-867-5570 rmedeiros@wynward.com |

Other

| Company | Description | Contact Information |

|---|---|---|

.png) |

Action Contents & Moving is an industry leader in full-service contents handling for insurance claims and restoration projects. With 60+ trained professionals, purpose-built warehouses and climate-controlled storage, we deliver pack outs, inventory, valuations and secure return of belongings while streamlining the claims process with speed, professionalism and peace of mind. |

Brad Sample |

|

Executrade is a trusted recruitment partner with over 50 years of experience connecting top talent to insurance organizations across Western Canada. From Account Executives to Claims, we provide flexible staffing solutions—including contract, temporary, and permanent placements—to help you build high-performing teams in a competitive talent market. |

Jeff Newman |

|

Beal Advisors works with Insurance companies throughout Canada to assist them with strategic issues such as Valuations, Strategic Planning, Succession Planning a,d exit. If you are looking to transition your business to the next generation, to your management team, or for a sale to an external party, and need advice and counsel on how to maximize your after tax proceeds, give us a call. |

Steven Beal |

|

|

Founded in 2017, CAMGA is the only voice of p&c MGAs and MGUs in Canada. Our mission is to represent and advocate for our members to capacity providers, brokers and insurance regulators. We are dedicated to fostering the highest standards of operational professionalism, ethics and innovative opportunities to present the channel as the most trusted underwriters in the industry. |

Steve Masnyk |

|

The Insurance Brokers Association of B.C. (IBABC) serves as the voice of the general insurance brokerage industry and promotes its members as the premier distributors of insurance products and services in British Columbia. |

Sarah Polson |

|

The Insurance Council of British Columbia is the provincial regulator and licensing body for life and general insurance agents, salespersons, and adjusters. We protect the public by ensuring that licensees act ethically, with integrity and competence. |

1-877-688-0321 |

|

The Insurance Institute is the premier source of professional education and career development for the property and casualty insurance industry in Canada. The Institute’s designations such as the CIP and FCIP are recognized by the insurance industry as the benchmark of insurance excellence and professionalism. Our programs are designed to appeal to all streams of the P&C industry. |

Winnie Hon 604-681-5491 ext. 22 whon@insuranceinstitute.ca |

.png) |

Ocean Wise is a BC-born globally focused nonprofit that builds communities to take meaningful action to protect and restore our ocean. We work together-with business leaders, researchers, community members, governments and ocean lovers around the world- to ensure a future in which the ocean is healthy and thriving. |

Alex Izard |

|

As a locally owned, private content management company, Priority Contents specializes in providing comprehensive contents management services across the Vancouver Lower Mainland and Fraser Valley. With a dedicated team of professionals, we understand the importance of handling your belongings with the utmost care, especially during challenging times like property restoration. |

Andrew Manning |

|

|

Prodigy Fire Solutions is a BC-based company specializing in permanent, roof-mounted wildfire sprinkler systems. Designed to protect homes and properties, our smart, app-controlled systems use high-quality materials and alternative water sources where possible to offer effective, reliable wildfire defense in high-risk areas. |

Kimberly Macualay |

|

Progressive Intercultural Community Services (PICS) Society supports immigrants, seniors, women, refugees, and youth with Employment, Settlement, Language, Housing, and Social Programs. Key initiatives under Career Services include FCR Loans for credential recognition, the IEHP program providing wage subsidies for healthcare professionals, Career Paths for Skilled Immigrants, and Employment Options for 55+. |

Shweta Soni |

|

Restoration

| Company | Description | Contact Information |

|---|---|---|

|

DKI Barclay Restorations is your one-stop, full-service restoration partner, trusted for our rapid response, certified expertise, and seamless execution from disaster to rebuild. Canadian-owned, locally driven, and relentlessly reliable, we don’t just restore properties, we restore peace of mind. |

Andrea May |

|

BELFOR is the largest Canadian disaster recovery and property restoration company for residential and commercial properties. We offer more services and solutions for property damage caused by water, fire, storms or mould than any recovery company in Canada. |

Natalie Duffielf |

|

DKI Canada members restore what matters most. With over 75 locations from coast to coast, our local experts deliver sustainable, innovative solutions for both commercial and residential property restoration. From emergency response and water mitigation to fire and contents cleaning, mould remediation, and full reconstruction, DKI is committed to industry-leading standards, every step of the way. |

Rick Morse |

.png) |

We are FIRST ONSITE, a leading property restoration and reconstruction company serving North America and beyond. We’re proud to provide industry leading services for industries of every kind: from healthcare and education, to commercial and residential. Our local, dedicated operations are backed by extensive national resources, so we can be first to arrive and first to make a difference for businesses and communities. |

Angela Batista |

|

Modern PURAIR® is British Columbia’s largest provider of Specialized Duct Cleaning and HVAC System Remediation for Restoration Projects. With a franchise network servicing every region of BC, we partner with leading restoration contractors and insurance providers to restore healthy indoor air after floods, fires, mold contamination, smoke damage, and other disaster events. |

Lane Martin |

.png) |

Paul Davis Restoration is a trusted leader in property restoration across Canada, specializing in emergency response, mitigation, restoration, and reconstruction for residential and commercial losses. With a network of over 60 locally owned and operated offices, we work closely with insurance professionals and brokers to deliver consistent, high-quality service, helping clients get back to normal—faster. |

David Corvers |

.png) |

Established in 1998, DKI—Precision Restorations Inc. is a full-service restoration company offering a range of services for residential and commercial customers, including water damage mitigation, contents restoration, smoke, and fire damage repair. DKI Precision Restorations services Metro Vancouver, Fraser Valley, Sea-to-Sky, North Okanagan, South Okanagan, and Thompson Valley. DKI Precision Restorations is also a proud corporate sponsor of Ronald McDonald House. |

Lorraine Thompson |

|

PuroClean Canada, a leader in 24/7 emergency & restoration services, helps families and businesses recover from devastating property loss. Our nation-wide network is committed to the needs of insurance professionals and their clients. |

Josh King |

|

|

ServiceMaster Restore is a leading provider of disaster restoration services, specializing in fire, water, and storm damage recovery. With over seven decades of experience and a reputation for excellence, we mitigate damages quickly to reduce loss severity for residential and commercial properties. Our team of dedicated and certified professionals are ready to offer the support, knowledge, and resources needed to help get your policyholder’s property – and life – back on track. ServiceMaster of Canada is a proud Canadian owned and operated national franchise network. |

Brian Bessey |

|

Founded in 1967, the SERVPRO® Franchise System is a leader and provider of fire and water cleanup and restoration services, and mould mitigation and remediation. Providing coverage in the United States and Canada, the SERVPRO System has established relationships with major insurance companies and commercial clients, as well as individual homeowners. |

Tom Zakeri |

|

WINMAR® (Canada) International, Ltd. is a trusted network of 90 plus locations providing quality property restoration services 24 hours a day, 365 days of the year. WINMAR®’s services include Fire, Water, Wind, and Mould Remediation by professionally trained and certified teams. Other services include Asbestos Abatement, Biohazard Remediation, Cleaning Possessions, Deep Cleaning, General Contracting, Commercial Loss, Disaster Cleanup, and Emergency Planning. With over 45 years of experience property owners across Canada rely on WINMAR® to restore what matters. |

Darren Christie |

Software & Tech Services

| Company | Description | Contact Information |

|---|---|---|

|

Acturis Canada is a single multi-use platform with the BMS, CRM, and Rating all imbedded into one system. This allows brokers to work through a streamlined journey eliminating the need for data entry duplication. Our Acturis Rater is working to build direct API Integrations with insurance companies allowing brokers to obtain quotes and documents, and bind business all within the BMS. |

Amber Clark |

|

Alstar Brokerage Solutions delivers ATOMS, a cutting-edge SaaS platform revolutionizing insurance agency management for P&C and life brokerages. With advanced CRM, automated commissions, accounting, and client portals, ATOMS boosts efficiency, ensures compliance, and drives revenue growth for innovative insurance brokerages and MGAs. |

604-936-3336 |

|

Applied Systems is the leading global provider of cloud-based software that powers the business of insurance. Recognized as a pioneer in insurance automation and the innovation leader, Applied is the world’s largest provider of agency and brokerage management systems, serving customers throughout the United States, Canada, the Republic of Ireland, and the United Kingdom. |

Jesse Kucher |

|

.png) |

Cemiar is a leading Insurtech software firm specializing in data integration and process automation through AI. Their innovative and modular API technology, CemiarLink, is transforming commercial and personal insurance lines by automating commercial billing, renewals, coverage validation, broker reassignment, fees billing, BMS-CRM synchronization, and bank reconciliation. |

Samuel Bélanger-Lamoureux |

|

The Centre for Study of Insurance Operations (CSIO) is a national property and casualty (P&C) insurance technology association with a member network that includes insurers, vendors, and over 43,000 brokers. CSIO develops Data Standards, manages distribution solutions such as CSIOnet and My Proof of Insurance and drives emerging technologies to enhance connectivity within the P&C broker channel. |

Isabelli Santos |

|

|

EC Managed IT is a leading Canadian provider of managed IT services offering strategic consulting, AI implementation, project management, and technology implementation. We are your people-first technology partner—driven to be helpful, inspired to innovate, and committed to delivering IT securely. |

Carson Thompson |

|

Geosapiens is a Canadian climate risk intelligence company delivering high-resolution flood (fluvial, pluvial, coastal) and wildfire models nationwide. Our modeling data supports underwriting, pricing, regulatory compliance, and portfolio management through a user-friendly web portal, robust APIs, and geospatial datasets, validated and trusted by leading Canadian P&C insurers. |

Emine Schultz |

|

ProNavigator is an award-winning knowledge management platform transforming the insurance industry. Thousands of insurance professionals use ProNavigator daily to help their back-office store, manage, and use their documents—like underwriting guidelines, wordings, and endorsements. The platform combines powerful insurance-focused search, organization controls and knowledge management capabilities to address critical information management challenges. |

Zach Misener |

.png) |

Quandri is an automation platform for insurance brokers to automate time-consuming and manual processes, to repurpose their staff to more meaningful work. |

Jackson Fregeau |

|

QuickFacts is is a platform that centralizes underwriting information from all of a brokerage’s carrier partners. It compares appetites, shows key documents, and simplifies workflows. Built by brokers, it helps cut onboarding time, reduce underwriter calls, and lower E&O risk, while boosting broker efficiency, morale, and sales. |

Jeff Barsalou |

|

|

Quotey simplifies commercial insurance with fast, digital quoting and submissions. Brokers get real-time market appetite, instant multi-insurer quotes, and beautifully packaged submissions—saving hours on every file. Built for Canadian brokers, Quotey helps you win more business, faster. |

Nick Kidd |

|

Rival Insurance Technology is a leading provider of solutions that improve the competitive position of our customers and business partners. Rival works collaboratively industry-wide to “Innovate Insurance Together” with a new generation of technology. Learn more at rivalit.com. |

Martin Ouellet |

|

|

Originating in the insurance sector, Trufla leverages AI to revolutionize distribution with tools for customer self-service, sales and insurance quoting, customer management, and digital marketing. Serving over 300 clients globally, Trufla’s diverse team drives innovation in insurtech. Recognized as 2022's Best InsurTech Provider by Insurance Business Canada. Visit trufla.com for more. |

Kristy Patton |

|

Opta is now Verisk, Canada’s leading provider of property intelligence and technology solutions. With roots in the Canadian Fire Underwriters’ Association (founded in 1883), Verisk Canada possesses the country’s most comprehensive structured risk information property database. Recognized for its innovative, industry-leading property validation tool, iClarify, Verisk Canada continues to deliver business intelligence that powers digital transformation for insurers and financial services companies in Canada—now with deeper resources than ever. |

Evan Byrne |

|

Vertafore Canada is a leading technology provider that offers a foundational BMS, helping Canadian brokers and their stakeholders become future-ready. Our open ecosystem enables seamless integration, modernizing brokerages and the insurance distribution lifecycle to unlock the full potential of every business. |

Julia Mitchell Dimitrios Argitis |

| YOVU Office Phone delivers cloud-based VoIP built for modern brokerages. Seamlessly integrate with BMS platforms like Applied EPIC, enable remote flexibility, and streamline client communication and backed by premium Canadian support. Empower your brokerage with smarter, scalable, insurance-ready phone solutions. |

Scott MacDougall scott.macdougall@yovu.ca Matthew Reid matthew.reid@yovu.ca |